TOB 306M-0809 free printable template

Show details

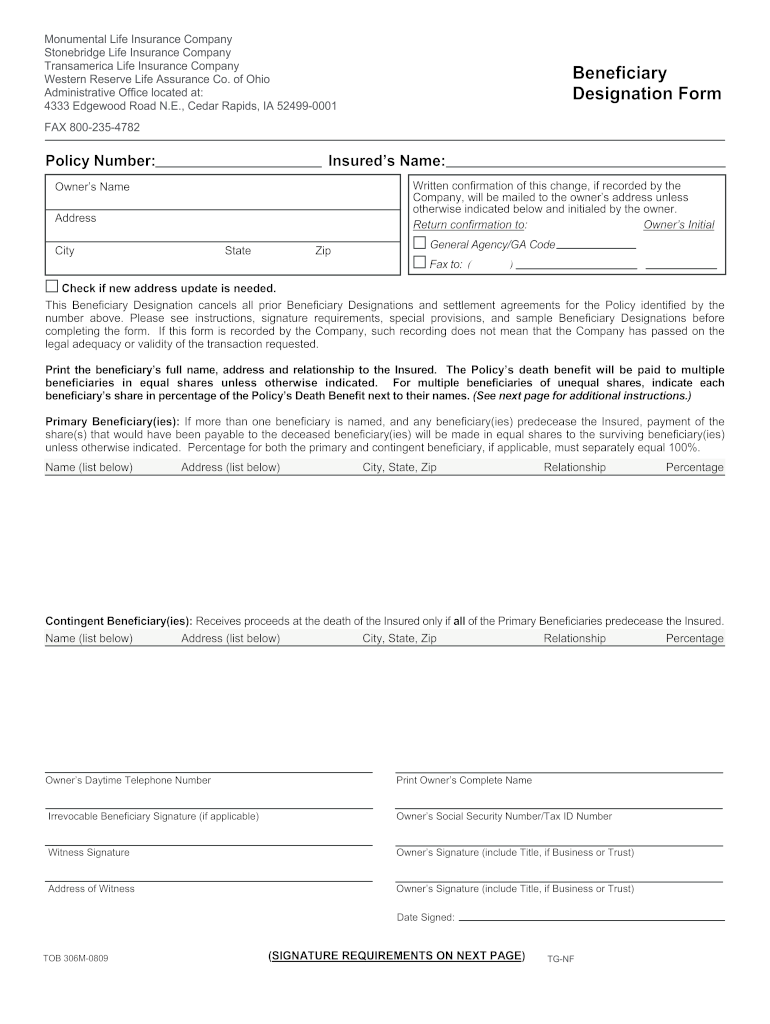

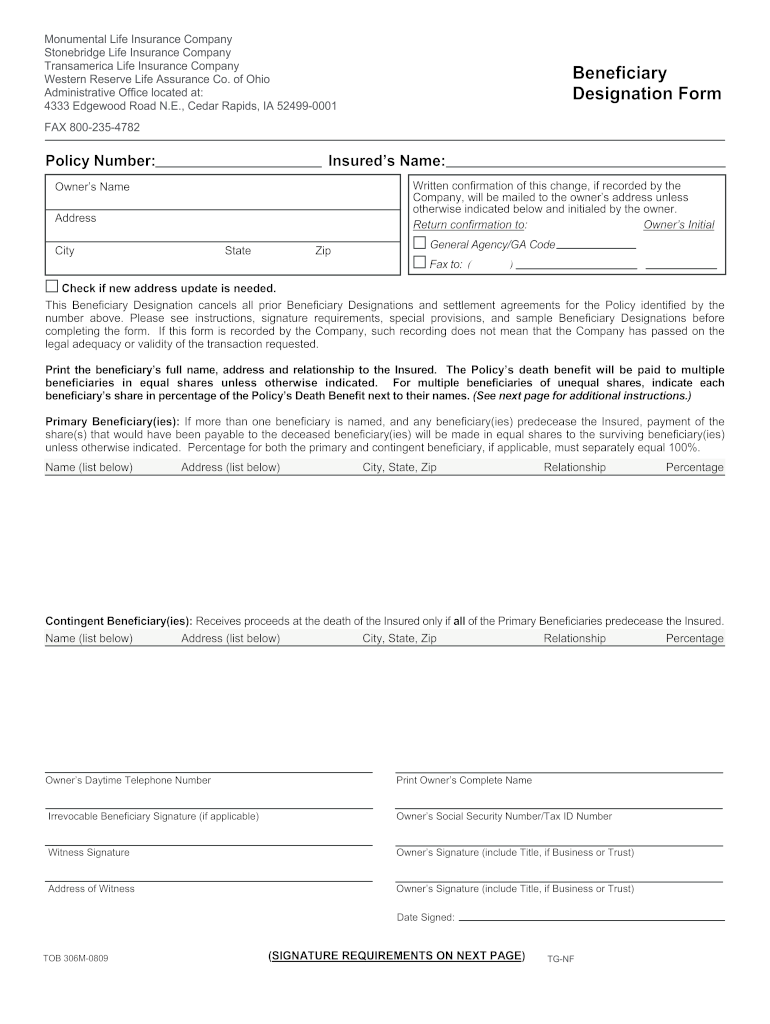

Reset Form Monumental Life Insurance Company Stonebridge Life Insurance Company Transamerica Life Insurance Company Western Reserve Life Assurance Co. of Ohio Administrative Office located at 4333 Edgewood Road N.E. Cedar Rapids IA 52499-0001 Beneficiary Designation Form FAX 800-235-4782 Policy Number Insured s Name Written confirmation of this change if recorded by the Company will be mailed to the owner s address unless otherwise indicated below and initialed by the owner. Reset Form...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign transamerica beneficiary change form

Edit your beneficiary change form transamerica form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transamerica life insurance beneficiary form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing transamerica beneficiary claim form online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit transamerica change of beneficiary form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out beneficiary designation transamerica form

How to fill out TOB 306M-0809

01

Begin by downloading the TOB 306M-0809 form from the official website or obtain a physical copy.

02

Fill in your personal information, including your name, address, and contact details, in the designated fields.

03

Provide accurate details of the specific transaction or situation that the form addresses.

04

If required, include supporting documentation that validates the information you provided.

05

Review the form for any errors or omissions to ensure accuracy.

06

Sign and date the form where indicated.

07

Submit the completed form according to the instructions provided, either online or by mailing it to the appropriate agency.

Who needs TOB 306M-0809?

01

Individuals or businesses involved in specific financial transactions that require reporting to the relevant authorities may need TOB 306M-0809.

02

Tax professionals or accountants may also require this form when preparing clients' financial documents.

Fill

transamerica beneficiary change form pdf

: Try Risk Free

People Also Ask about esign

What was the former name of Transamerica life insurance company?

(formerly, Life Investors Insurance Company of America) Life Investors Insurance Company of America (“LIICA”) merged with and into its affiliate Transamerica Life Insurance Company (“Transamerica Life”) on or about October 2, 2008.

How to cash out Transamerica life insurance?

Please send a letter or fax requesting the surrender of your Policy/Certificate. Please include the insured's name, the Policy/Certificate number, the signature of the policyowner, and the date of the request. Please allow up to 3 weeks to receive a check for the cash value of your policy.

Is Transamerica a life insurance company?

Life insurance from Transamerica helps protect people's financial future with solutions through every stage of life. Explore our range of cost effective options below, and rest easy.

How do I file a death claim with Transamerica?

Contact the Transamerica Claims Customer Service Department at: 888-763-7474. 2. Have all claim information ready to provide.

How long does it take Transamerica to process a death claim?

If your claim is approved you'll receive your payment 7 to 10 days after the final approval.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit transamerica life insurance beneficiary change form on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing beneficiary transamerica change online.

How do I fill out beneficiary transamerica change using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign beneficiary form transamerica pdf and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit transamerica change of beneficiary on an iOS device?

Use the pdfFiller mobile app to create, edit, and share transamerica beneficiary fillable from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is TOB 306M-0809?

TOB 306M-0809 is a specific form used in tax reporting, typically associated with the reporting of certain transactions or activities for regulatory purposes.

Who is required to file TOB 306M-0809?

Entities or individuals engaging in the activities or transactions specified by the regulatory authority are required to file TOB 306M-0809.

How to fill out TOB 306M-0809?

To fill out TOB 306M-0809, collect all required information, follow the provided instructions carefully, and ensure all sections are accurately completed before submission.

What is the purpose of TOB 306M-0809?

The purpose of TOB 306M-0809 is to ensure proper reporting and documentation of specific transactions or activities for compliance with regulatory standards.

What information must be reported on TOB 306M-0809?

The information that must be reported on TOB 306M-0809 generally includes details about the transactions, participants, amounts, and any other relevant data required by the regulatory body.

Fill out your TOB 306M-0809 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transamerica Beneficiary Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to transamerica name change form

Related to transamerica beneficiary pdffiller

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.